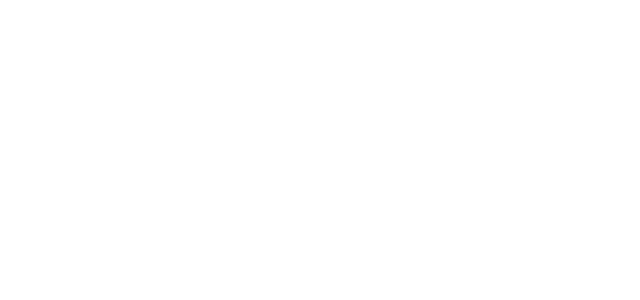

Unfortunately, there’s no such thing as a perfect portfolio. The performance of your portfolio hinges on several different factors, many of which are out of your control. As the stoic philosophers would say: if we focus on the things that matter, paired with the things we can control, we are probably headed in the right direction. Anything else is simply an exercise in frustration.

So. What exactly can we control when it comes to investing?

We can:

- Develop a financial plan and an investment strategy which we have confidence to stick with, in all market cycles (good and bad!)

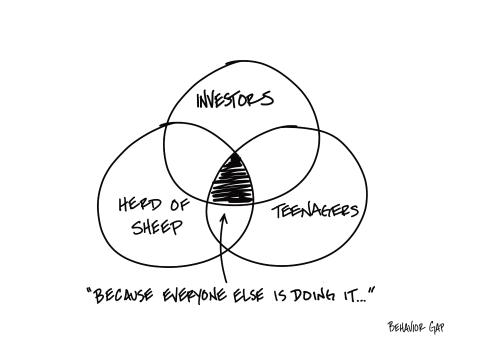

- Choose to believe the evidence vs. the hype (media, the herd, ‘a guy’ at work)

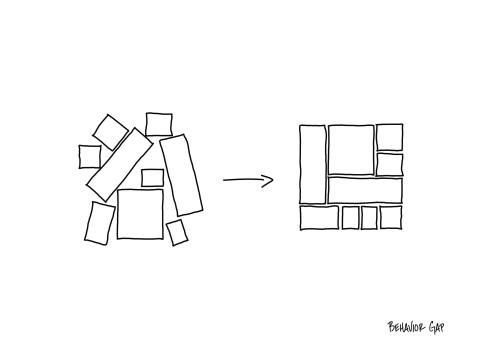

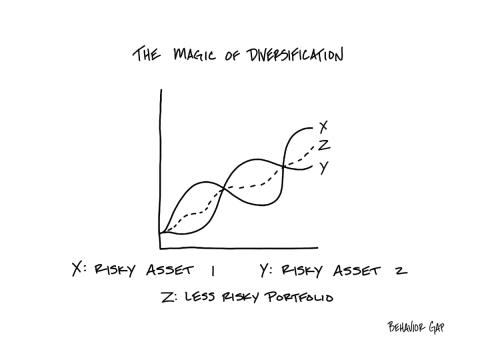

- Construct an asset allocation appropriate for our goals and diversify globally

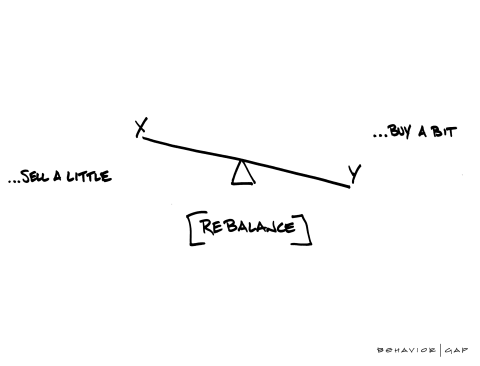

- Rebalance regularly

- Focus on strategies to keep costs low

- Add in a shock absorber during or approaching retirement for when, not if, the market goes down

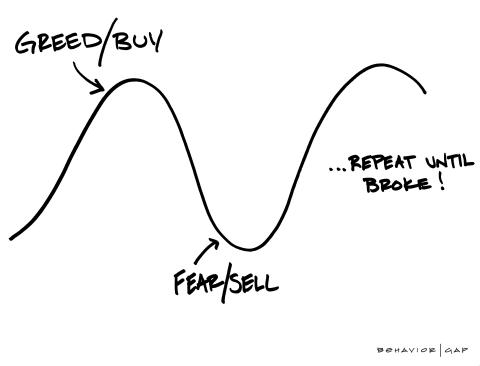

- Recognize the aspects of behavioural economics and psychology that are working against us by making evidence based decisions and ignoring the ‘noise’

All of the above are things which add value and that we can control. These will help us to ‘stay the course’ during the inevitable times when things that we can’t control throw us a curve ball.

Have a Plan

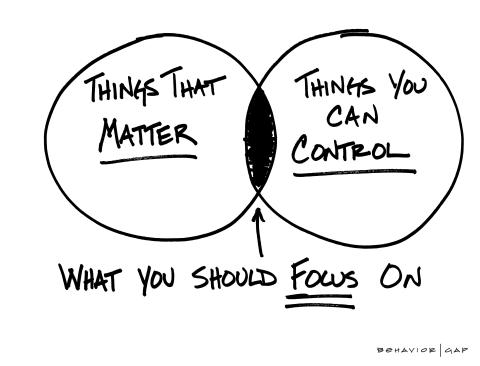

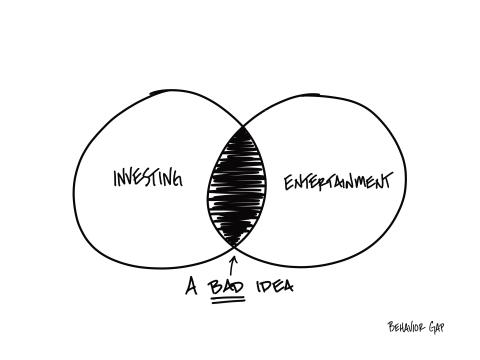

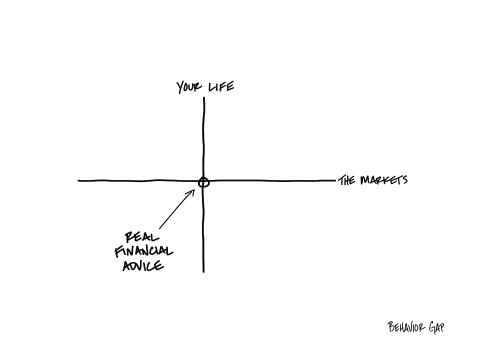

What is the Rockwater Wealth Management ‘secret sauce’ for smart investment management? It starts with the plan. Your investments are a tool you use to support a goal. They should not be a form of entertainment.

We start with a discovery interview to determine WHY you are investing, and your specific goals. Next, we create a plan paired with a strategy to make sure the plan stays on track, making course corrections as needed. Only then are we able to make an investment recommendation. Your WHY and your PLAN are infinitely more important than choosing between Investment A or Investment B.

Invest Smarter

We always focus on an evidence-based approach to investing rather than the latest trends and media hype, to ensure the most logical approach. For your financial success, it’s crucial that all investment decisions should hold up to current empirical data, research, studies, and of course, common sense.

Smart Asset Allocation and Diversification

Why Rebalance?

Regularly, we will review your portfolio to ensure your investments reflect your goals and target asset allocation. Rebalancing is simply the automation of selling a little of the outperformers and buying a little of the underperformers to bring us back to our target asset allocation. In essence, it automates the process of potentially buying low and selling high, thus taking emotions out of the decision-making process. A regular rebalancing strategy helps to avoid emotional reactions to market volatility.

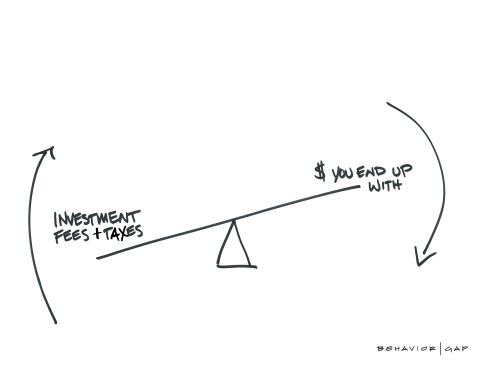

Minimize Costs & Taxes

Another area where you have control is taxes and expenses, which have an undeniable impact on your investment results. At Rockwater Wealth Management, we use specific and proven strategies to help minimize the impact of fees and taxes on your finances, and help you keep more of what you’ve earned.

What’s a Shock Absorber?

As much as possible, you should try to protect yourself from having to sell when the markets are low. So, when you are three to five years away from retirement, or in retirement, we put three years of income in something that is less volatile. We call this a shock absorber. When we get together and the markets are up, we top it back up to three years. When we get together and the markets are down, we don’t top it up and wait for the next meeting. Simple, right?

Long-Term Focus Over Forecasting

We believe it’s an exercise in futility to spend time and energy trying to predict market tops, bottoms, or directions. We’re not market timers or short-term traders. Forecasting is completely unreliable; just think about how often forecasts miss the mark in everything from sports, to politics, to the weather. Financial markets have just as many variables impacting results, and the chance of accurately guessing outcomes and market changes is low. That’s why we prefer a disciplined, fact-based approach that takes advantage of academic evidence and historical drivers of return versus emotional decision making.

The Bottom Line

We believe that the markets are efficient and trust that they will do their jobs over time. With that in mind, we direct all of our time and attention to the things that REALLY matter and the things we can actually control. Again, we aren’t investing for the sake of investing. We are investing because we have a GOAL and behind that goal should be a really strong WHY. This makes sure that we don’t lose sight of exactly what we are solving for. This is REAL financial advice